Due to increasing adoption worldwide, cryptocurrencies are generating higher income from transaction fees than major mainstream companies. For the flagship digital currency, a spike in fees happened despite price fluctuations and a miners’ crackdown in China.

According to the research data analysed and published by Wette.de, total transaction fees on the Bitcoin network in Q2 2021 hit $416.6 million. Compared to the $48.5 million recorded in Q2 2020, that was a 750% year-over-year (YoY) jump.

The calculated annualized revenue run rates (ARR) for the transaction fees rose to $2.986 billion in April. This figure is higher than the ARR of Shopify for the past year, which was $2.929 billion.

There was also a considerable increase in the median transaction fees as well as the media daily active addresses on the network. In the three-month period, median transaction fees rose by 1.080% from $1.24 in Q2 2020 to $14.64. Median daily active addresses saw a jump of 11.5% from 880,000 in Q2 2020 to 982,000.

Total BTC transaction volume rose nearly fivefold, going from $120.2 billion to $527.1 billion, a 338% YoY increase.

Though the second quarter of 2021 was positive for Bitcoin, there were a number of challenges working against growth. Foremost among these was the Chinese crackdown on miners that was partly responsible for a huge price decline. After hitting an all-time high of nearly $65,000 in April, the asset closed the quarter at around $35,000.

Bitcoin Average Transaction Fee Down from $63 to $2 in Five Months

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), close to half of Bitcoin’s mining hash rate came from China (46.04%) in April 2021. At the time, the US was the second-biggest mining country, accounting for 16.85% of total mining hash rate. China’s neighbour, Kazakhstan, ranked third with 8.19%.

As a result of the mining crackdown, BTC transaction fees in June fell by 93% from April highs. Trading volume, on the other hand, nearly halved from the all-time high set in May.

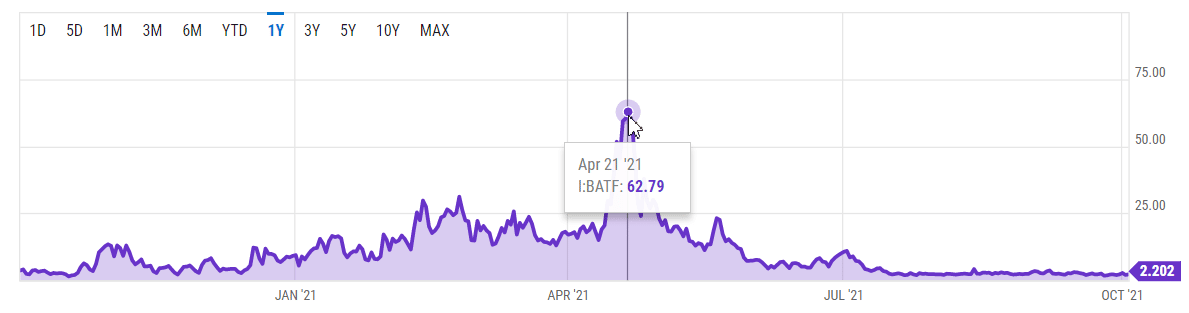

At its peak in April 2021, Bitcoin average transaction fee was $62.79 according to YCharts, falling to $4.38 by June 6. Within the first eight days of June, daily trading averages dropped from a May high of $67 billion to $34.8 billion. As of October 4, 2021, it stood at around $2.

Bitcoin’s overall rise in Q2 transaction fees was not an isolated case as multiple other cryptocurrencies saw similar, if not higher, spikes.

According to ETC Group, Ethereum’s transaction fees shot up by a stunning 5,000% in Q2 2021. The surge came about following a steep rise in transaction volumes on the network. From $36.7 billion in Q2 2020, total transaction volume rose by 2,000% YoY to $777.1 billion in the period.

Notably, Ether’s trading volume during the first half of the year was higher than that of Bitcoin. In the six-month duration, Bitcoin trading volume rose by 489% from $356 billion to $2.1 trillion. On the other hand, Ether saw a 1,461% jump from $92 billion to $1.4 trillion.

Global Crypto Adoption Surged by 881% Over the Past Year

Analysts from Coinbase state that there were two main contributing factors to Ethereum’s growth in trading volume. These include surging interest from institutional investors and growing adoption thanks to decentralized finance.

Growing adoption applies across the board for the crypto industry. According to a Chainalysis report, global cryptocurrency adoption skyrocketed by 881% over the past year.

Per the Chainalysis index, Vietnam is the leading country globally in terms of digital asset adoption. India and Pakistan follow closely behind. The index bases its score on three metrics – trading activity of non-professionals, peer-to-peer exchange trade volume and total crypto activity.

In the ranking of 154 countries, a majority of the countries in the top 20 are emerging nations. Part of the reason for this is that the index does not include gross transaction volume, which tends to favour developed countries.

Developed countries typically have high levels of institutional and professional buy-in. For emerging nations, however, the rise in adoption stems from a number of factors. These include sending and receiving remittances as well as carrying out business transactions. Moreover, some residents have turned to digital assets due to fiat currency devaluations.

The latest rankings have the US in the eighth position, down from sixth in 2020. China has dropped from the fourth spot to 13 th , likely due to the spring crackdown on mining.

A great opportunity to use cryptocurrencies are Online bookmaker. Check our comparison of the most reliable and known providers for online games at Wettanbieter im Vergleich.